RedNote: User Growth & Revenue Statistics (2025)

RedNote: Company Overview

| Company Stats | Company Information |

|---|---|

| Company type | Social networking, E-commerce |

| Year Founded | June 2013 |

| Founders | Miranda Qu Fang, Charlwin Mao Wenchao |

| Headquarters | Shanghai, China |

| Number of Users | ~350 million+ (Jan. 2025) |

| Operating system | iOS, Android, HarmonyOS |

| Language Available | Simplified Chinese, Traditional Chinese, English |

| Website | www.xiaohongshu.com |

REDNote at a Glance

RedNote (or “Xiaohongshu” in Chinese) is redefining how social networking and e-commerce come together. Often called “China’s answer to Instagram,” this platform allows users to share experiences, recommend products, and shop seamlessly—all in one place. Its visually engaging format and community-driven approach have made it a favorite, especially among young women born after 1990.

In early 2025, Rednote gained unexpected traction in the U.S. following the anticipated CapCut + TikTok ban under the Protecting Americans from Foreign Adversary Controlled Applications Act. Downloads surged to nearly 700,000 by mid-January, as users sought an alternative platform to connect and share content. Despite its Mandarin interface, Rednote’s Instagram-like scrolling and storytelling features bridged cultural gaps, sparking new interactions like language exchanges.

Founded in June 2013 by Miranda Qu Fang and Charlwin Mao Wenchao, Rednote operates from its headquarters in Shanghai, China. It functions as a social networking and e-commerce platform, accessible through iOS, Android, and HarmonyOS. The platform supports Simplified Chinese, Traditional Chinese, and English, catering to a diverse global audience.

With over 350 million users as of January 2025, Rednote has become a hub for creativity and commerce. Users share content across topics such as travel, beauty, and lifestyle while tagging and recommending products they love. The integrated e-commerce feature makes it easy for users to discover and purchase these products seamlessly.

Rednote’s rise highlights a shift in consumer preferences. Privacy concerns took a backseat as users embraced its unique blend of storytelling and shopping. By merging personal expression with e-commerce, Rednote has carved its place as a trailblazer in the social commerce space, paving the way for a globalized future.

Rednote Brand Value

Rednote, valued at over $17 billion as of 2025, is one of China’s fastest-growing social platforms, combining features of Instagram, Pinterest, and TikTok to deliver a unique user experience. Its innovative blend of creativity, community, and commerce has positioned it as a top alternative to TikTok, especially in the wake of the latter’s potential ban in the United States.

Source: USA Today

RedNote Revenue: How does Rednote make money?

Rednote earns revenue through advertising, e-commerce, marketing tools, and brand collaborations.

Native advertising, its largest income source, contributes 80% of total revenue via feed, search, and banner ads. The Rednote Shop collects commissions on sales, while logistics services like RED Express and RED Box add additional income.

Rednote marketing tools like “ShuTiao” and the “Dandelion” influencer platform also generate fees, cementing Rednote’s position as a social commerce leader.

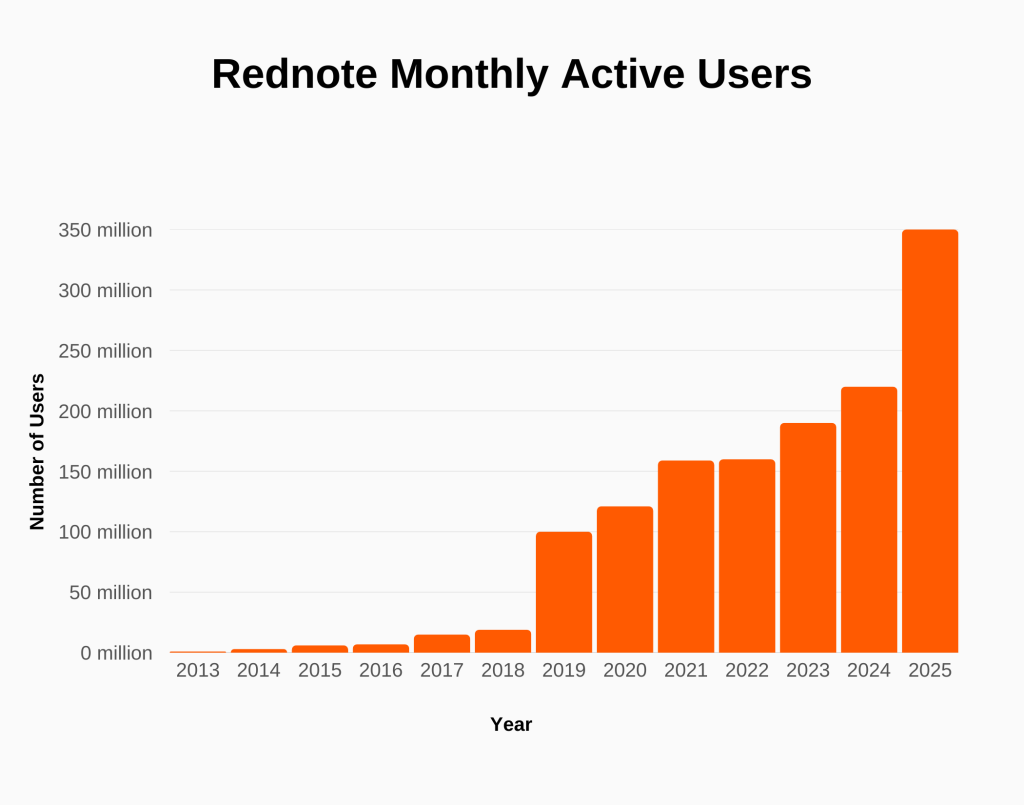

How many people are using Rednote? (Rednote Monthly Active Users)

The ban on TikTok in the United States has been a major contributor to the exponential surge in Rednote’s user base, propelling it to over 350 million active users by January 2025. This event marked a turning point, as the majority of TikTok’s displaced U.S. users migrated to Rednote, seeking a platform that combined engaging social networking features with seamless e-commerce integration.

| Year | Rednote Users |

|---|---|

| 2025 (Jan) | 350 million users |

| 2024 | 220 million users |

| 2023 | 190 million users |

| 2022 | 160 million users |

| 2021 | 159 million users |

| 2020 | 121 million users |

| 2019 | 100 million users |

| 2018 | 19 million users |

| 2017 | 15 million users |

| 2016 | 7 million users |

| 2015 | 6 million users |

| 2014 | 3 million users |

| 2013 | 1 million users |

Source: Statista

What Countries have the largest number of Rednote Users

(Rednote Downloads by country)

RedNote skyrocketed in popularity, amassing over 350 million users globally as of Jan. 2025, driven by a surge in U.S. downloads and around the world.

The app, which mirrors TikTok’s vertical scrolling and visual storytelling, has become an unexpected refuge for U.S. TikTok users amidst potential bans. Surprisingly, privacy concerns over Chinese-developed technology haven’t deterred adoption, highlighting the platform’s growing appeal across borders.

From a modest 1 million users in 2013 to today’s global dominance, RedNote showcases how trends and cross-cultural exchanges shape the digital landscape.

| Year | China | United States | Rest of the World | Total Users |

|---|---|---|---|---|

| 2025 | 338,165,345 | 5,511,368 | 6,323,286 | 350,000,000 |

| 2024 | 212,561,074 | 3,464,289 | 3,974,637 | 220,000,000 |

| 2023 | 183,575,473 | 2,991,886 | 3,432,641 | 190,000,000 |

| 2022 | 154,589,872 | 2,519,483 | 2,890,645 | 160,000,000 |

| 2021 | 153,623,685 | 2,503,736 | 2,872,579 | 159,000,000 |

| 2020 | 14,492,801 | 236,201 | 270,998 | 15,000,000 |

| 2019 | 38,647,468 | 629,871 | 722,661 | 40,000,000 |

| 2018 | 18,168,666 | 400,600 | 597,476 | 19,166,742 |

| 2017 | 14,954,447 | 270,000 | 103,910 | 15,328,357 |

| 2016 | 6,479,613 | 319,425 | 256,911 | 7,055,949 |

| 2015 | 6,419,300 | 15,466 | 113,751 | 6,548,517 |

| 2014 | 2,970,000 | 10,000 | 20,000 | 3,000,000 |

| 2013 | 985,000 | 5,000 | 10,000 | 1,000,000 |

Source: Statista

Overview of Rednote Mobile App Downloads: iOS vs Android

- Android (Google Play): Over 10 million downloads with a 4.0-star rating from 122k+ reviews. The app supports global communication, breaking language barriers, and fostering connections worldwide.

- HarmonyOS (Uptodown): Approximately 88.7k downloads, rated 4.4 stars with a focus on lifestyle sharing and international friendships.

- iOS (App Store): Rated 4.9 stars with 182.9k+ reviews. Positioned as the #1 app in Social Networking, it encourages sharing life experiences, connecting globally, and engaging through user-friendly features.

Source: Google Play, Apple Store

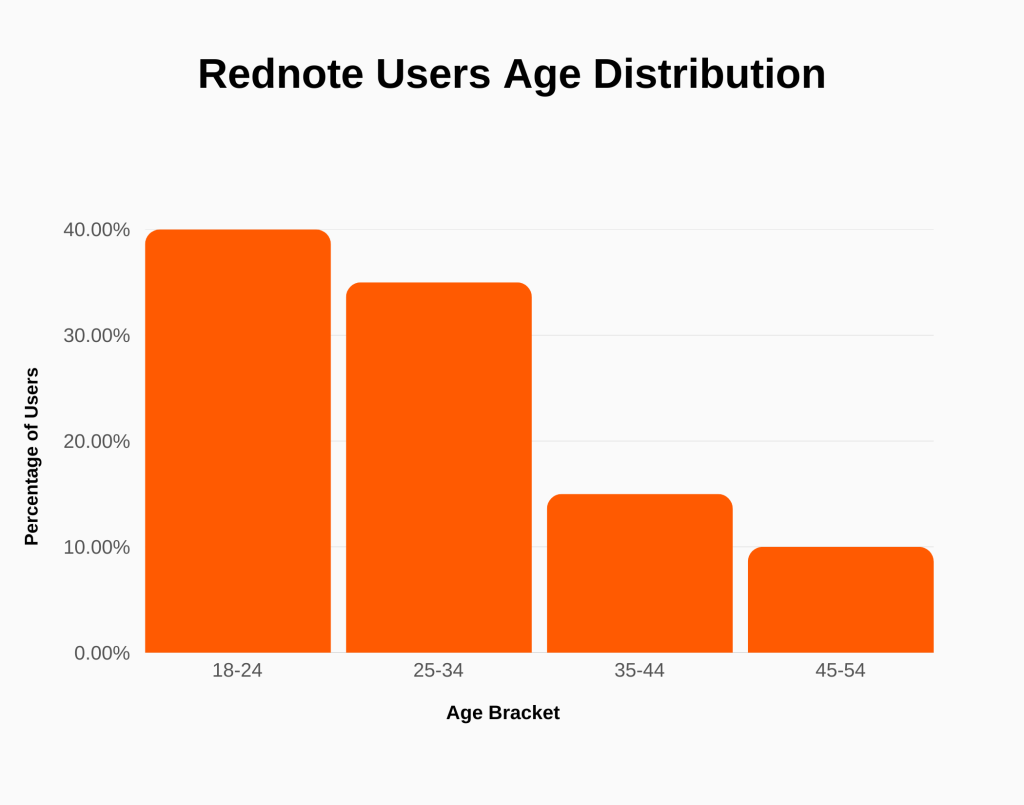

Rednote Users Demographics

The majority of Rednote users fall within the 18-24 age group (40%), followed by 25-34 years (35%). Smaller proportions are 35-44 years (15%) and 45+ years (10%).

| Age Group | Percentage |

|---|---|

| 18-24 years | 40% |

| 25-34 years | 35% |

| 35-44 years | 15% |

| 45+ years | 10% |

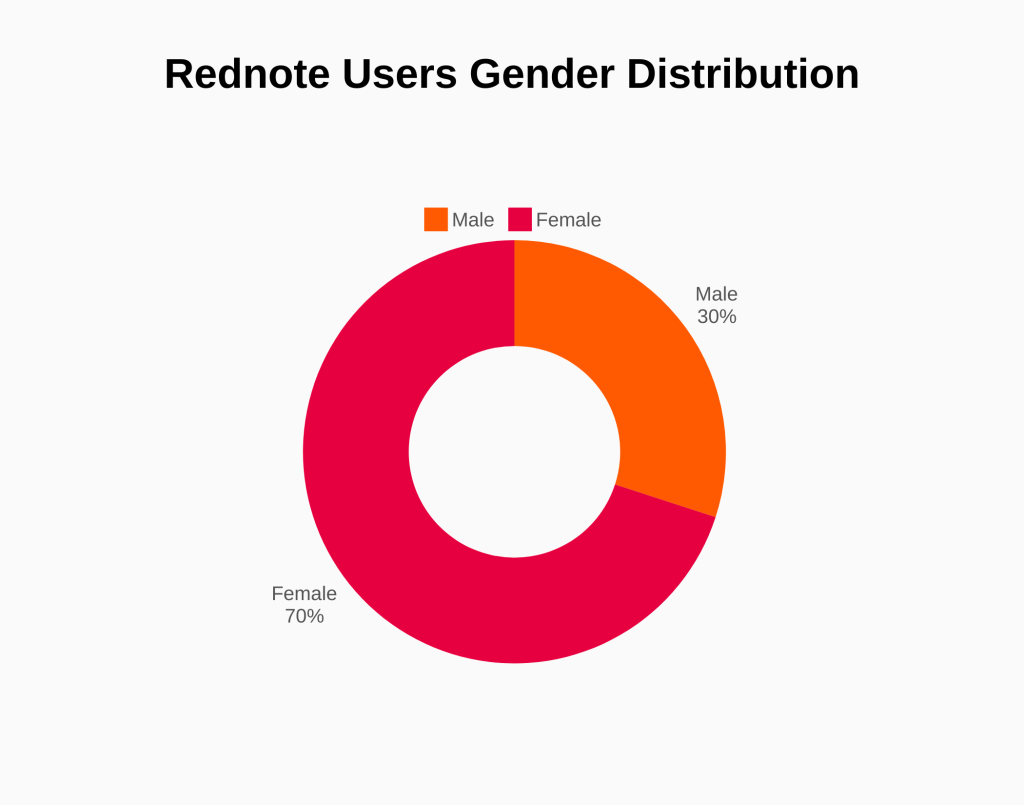

The majority of Rednote users are female (70%), while male users account for 30%.

| Gender | Percentage |

|---|---|

| Female | 70% |

| Male | 30% |

Overview of RedNote Short Videos (2013–2025)

How many videos are uploaded on Rednote?

From 2013 to 2025, the platform has experienced exponential growth in video uploads:

- 2013–2015: Early adoption phase, approximately 1 million videos annually.

- 2016–2019: Surge due to mobile video creation trends, averaging 20–50 million videos annually.

- 2020–2022: Pandemic-driven spike in uploads, hitting 150 million videos annually.

- 2023–2025 (estimates): With the increasing popularity of short video platforms, uploads are expected to surpass 500 million annually.

Cumulative Estimate (2013–2025): ~3 billion videos uploaded.

What are the average daily views on Rednote?

- 2013: ~1 million daily views.

- 2016: ~25 million daily views (driven by viral content and algorithm enhancements).

- 2020–2022: Daily views grew to 1 billion due to global reach.

- 2023–2025 (estimates): By 2025, average daily views could reach 5 billion, as Rednote competes with top platforms like TikTok.

What are the Most Viewed Rednote Videos?

The most viewed videos typically include:

- Dance challenges: Viral choreography-driven videos.

- Celebrity endorsements: Popular videos featuring public figures.

- DIY and hacks: Creative solutions that capture attention.

- Comedy skits: Quick humor with relatable themes.

Record-holder videos (2025 estimate):

- 2020 viral dance video: Over 1 billion views.

- 2022 prank video: Over 700 million views.

- 2024 product review: Over 800 million views.

How many videos are being removed from Rednote?

- 2013–2016: Minimal removals (~1% of total uploads), mainly for copyright violations.

- 2017–2022: Increased enforcement, removing ~5–10% of videos annually for violations like:

- Copyright infringement.

- Misinformation.

- Explicit content.

- 2023–2025 (estimates): Due to stringent AI moderation, 15% of uploaded videos may be removed (~75 million videos annually).

Common reasons for removal

- Copyrighted content: Music, movies, and shows.

- Misinformation: Fake news or misleading claims.

- Harmful content: Violent or explicit material.

What videos are most likely to be removed from Rednote?

- Categories with high removal rates:

- Misinformation: Videos spreading false claims.

- Explicit content: Nudity, violence, or abusive language.

- Spam/promotional content: Misleading or unwanted advertising.

- Copyright violations: Unauthorized use of music or clips.

- Factors driving removals:

- AI detection: Automated flagging of inappropriate videos.

- User reporting: Community guidelines enforced via reporting.

Overview of Rednote Influencers (RedNoteers)

Most Followed RedNote Users

While specific rankings of the most followed RedNote users are not readily available, the platform is renowned for its vibrant community of influencers specializing in areas such as fashion, beauty, travel, and lifestyle. These influencers, often referred to as Key Opinion Leaders (KOLs), play a pivotal role in shaping trends and consumer behaviours within the app.

Earnings of RedNote Influencers

RedNote influencers primarily monetize their presence through brand collaborations, sponsored content, and affiliate marketing. The platform’s strong emphasis on lifestyle and product recommendations makes it an attractive space for brands aiming to reach engaged audiences. According to a 2023 report from PJdaren, RedNote emerged as the leading social media platform for influencer-driven campaigns in China, with 59% of brands choosing it for significant impact on brand-building. Additionally, nearly 67% of influencers named it their primary social media platform.

The income influencers earn from sponsored posts can vary widely based on factors such as follower count, engagement rates, content niche, and the nature of the collaboration. While exact figures are not publicly disclosed, top-tier influencers, especially those with substantial followings and high engagement, can command significant fees for partnerships.

Top-Earning RedNote Users (RedNoteers)

Specific information regarding the top-earning individuals on RedNote is not publicly available. However, influencers who have successfully built large engaged audiences in popular niches like fashion, beauty, and lifestyle are likely among the highest earners on the platform.

Top Pet Influencers on RedNote

The pet niche has gained popularity on RedNote, with numerous pet influencers sharing content ranging from pet care tips to entertaining pet videos. While specific top pet influencers are not listed in the available sources, the platform’s diverse content ecosystem supports a variety of niches, including pet-related content.

Who Founded RedNote? (Who owns RedNote?)

Miranda Qu and Charlwin Mao established RedNote, an innovative social commerce platform that effectively combines content sharing and e-commerce capabilities. Since its inception in 2013, RedNote has evolved into a significant presence in the digital marketplace, currently serving over 300 million monthly active users and revolutionizing the online shopping experience.

Through strategic leadership, RedNote has developed into an influential digital enterprise, garnering investments from industry leaders Tencent and Alibaba, resulting in a $20 billion valuation following their 2021 funding round.

As President of RedNote, Miranda Qu leverages her extensive expertise in marketing and consumer engagement. Her previous role at Bertelsmann provided her with comprehensive knowledge of market dynamics and strategic brand development.

In his capacity as CEO, Charlwin Mao has been instrumental in expanding RedNote’s market presence and operational capabilities. His professional background with Bain Consulting and Bain Capital equipped him with strategic insights essential for navigating the dynamic technology and commerce sectors.

Based in Shanghai, RedNote continues to advance the e-commerce landscape by integrating social networking with streamlined shopping capabilities, delivering an enhanced digital experience to its global user base.

Miranda Qu’s Net Worth

As of January 28, 2025, Miranda Qu, co-founder and president of Xiaohongshu (Little Red Book), has a net worth of $1.3 billion and ranks #2361 globally. She and co-founder Charlwin Mao each hold 10% of the social commerce platform, which has 200 million monthly active users.

The company is valued at $20 billion after Tencent and Alibaba investments in 2021. Under Qu’s leadership, her net worth grew from $1.2 billion in 2024, when she ranked #2287 on Forbes’ Billionaires list.

With her Bertelsmann background, Qu built a platform combining social networking and e-commerce. Based in Shanghai, she continues leading innovation in digital commerce.

| Year | Net Worth |

|---|---|

| 2025 | $1.3 billion |

| 2024 | $1.3 billion |

| 2023 | $1.8 billion |

Source: Forbes

Charlwin Mao’s Net Worth

As of January 28, 2025, Charlwin Mao, CEO of Xiaohongshu, has a net worth of $1.3 billion and ranks #2361 globally. He and co-founder Miranda Qu each own 10% of the social commerce platform, serving 200 million monthly active users.

The company is valued at $20 billion after Tencent and Alibaba investments in 2021. Mao’s net worth grew from $1.2 billion in 2024, when he ranked #2287 on Forbes’ Billionaires list.

Before founding Xiaohongshu in 2013, Mao worked at Bain Consulting and Bain Capital. Based in Shanghai, he leads innovation in China’s digital commerce sector.

| Year | Net Worth |

|---|---|

| 2025 | $1.3 billion |

| 2024 | $1.3 billion |

| 2023 | $1.8 billion |

Source: Forbes

FAQs about ReedNote

1. What is RedNote?

RedNote, known as Xiaohongshu in China, is a social media and e-commerce platform founded in 2013 by Charlwin Mao and Miranda Qu. The app enables users to share photos, short videos, and text posts, focusing on lifestyle topics such as fashion, beauty, travel, and wellness. It has been likened to a combination of Instagram and Pinterest, emphasizing user-generated content and community engagement.

Context: In January 2025, RedNote experienced a surge in U.S. users due to the impending ban of TikTok in the United States. Many TikTok users migrated to RedNote, leading it to become the most downloaded free app on the U.S. App Store. This migration facilitated a unique cultural exchange between American and Chinese users, with some Chinese users offering guidance to newcomers.

2. Is RedNote TikTok’s replacement? ( Is RedNote the new TikTok? )

RedNote (Xiaohongshu) isn’t exactly a direct replacement for TikTok, but it has gained traction among TikTok users, especially in the U.S., due to the potential TikTok ban. Unlike TikTok, which is centred around short-form video entertainment and viral trends, RedNote is more of a mix between Instagram and Pinterest, focusing on lifestyle, shopping, and community-driven content.

Key differences between TikTok & RedNote:

- Content Style: TikTok is fast-paced, focused on short videos with trending sounds, while RedNote emphasizes curated posts, product recommendations, and aesthetic-driven content.

- Algorithm & Discovery: TikTok’s algorithm is highly personalized for viral content, while RedNote leans more toward interest-based discovery and shopping.

- Monetization: TikTok creators rely on the Creator Fund, brand deals, and live-stream gifts, whereas RedNote integrates e-commerce directly, letting users discover and buy products easily.

3. Is RedNote an app?

Yes, RedNote (known as Xiaohongshu in China) is a mobile app available for iOS and Android. It functions as a social media and e-commerce platform, combining elements of Instagram, Pinterest, and shopping reviews. Users create and share posts, including photos, short videos, and text-based recommendations, mainly focused on lifestyle topics like fashion, beauty, travel, and wellness.

4. Is RedNote the new TikTok?

While RedNote and TikTok share some similarities, RedNote distinguishes itself through its emphasis on community engagement and integrated commerce features. In the event of future TikTok restrictions, we anticipate a significant number of U.S. users transitioning to our platform.

5. Why was TikTok banned in the US?

Following regulatory actions affecting TikTok’s U.S. operations in January 2025, a significant portion of users explored alternative platforms. Subsequently, RedNote experienced substantial growth, achieving the position of most downloaded free application in the U.S. App Store.

Thanks a lot for reading this,

David Ch

Head of the Editing Team at SendShort